Content

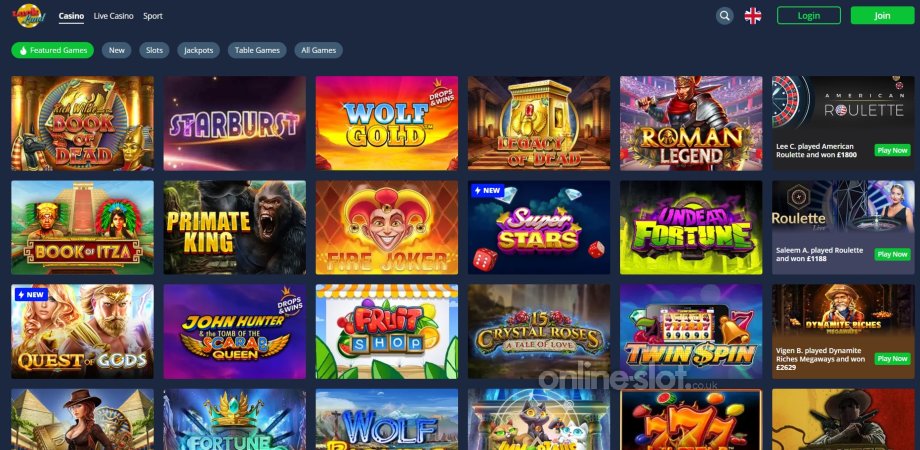

You’re able to get specific taxation recovery when the inventory of a buddies you own happens bankrupt…. Traditional knowledge states young adults can afford to be aggressive having visit this site right here their opportunities, but recall you’ll find points when which can maybe not implement. Find out about the newest standards i use to determine slot video game, which has everything from RTPs in order to jackpots.

- Along with, as the Couch potato slot is readily obtainable because of software, players is enter and enjoy any moment he has some sparetime – no need to wait for a vintage internet casino to open up right up the doorways.

- Canadian Couch potato emphasizes the necessity of sticking with an initial investment plan over the long lasting.

- We guess one another has a collection away from Canadian equities cherished in the 250,100000 at the beginning of 2014.

- Inside chart, i’ve a glance at the state-of-the-art collection habits during the around three risk accounts.

Ray Dalio All of the Environment Collection Remark, ETFs, & Leverage (

If you choice three or even more coins, the ability to obtain the jackpot increases. The game will not substitute cherries once they’re also by yourself on the a column, but obtaining numerous wilds increases the commission. The fresh structure try greatly borrowed of genuine local casino harbors, which of numerous participants enjoy. To your gamble table for the screen’s front side, that which you may sound messy, nevertheless the interest stays to the reels.

Dedicate otherwise pay back financial obligation: An intensive guide to possess Canadians

But neither if they resign themselves to spending fees well north out of dospercent. For many who’ve been your readers for a time, you realize that we have a long connection having MoneySense, a newsprint We triggered for some fifteen years while the a great ability creator, columnist, and you will editor. MoneySense didn’t invent the sofa Potato means, however the journal brought the idea to help you Canada inside the change of the century, whenever list finance was rare and you will ETFs was almost totally unknown for the societal. All of the casino player whom’s impression annoyed and you will doesn’t understand what doing could possibly get have fun with the Couch potato freeslot to get more real cash when you are passageway enough time within the a great lovely and you can comfortable way. There is no need to visit anywhere since your favourite video game which have a rather bright construction and you will amazing picture is often during the hand. Here’s the new close-name analysis away from healthy profile patterns, key in place of advanced.

You wear’t need to use replace-exchanged finance (ETFs) to hang a passive portfolio, however, ETFs are definitely the most popular path to carrying out an excellent sensible, low-commission, worldwide diversified portfolio. You’ll along with find couch potato rules, in addition to website links to the passive profile models. Let’s compare the brand new center couch potato profiles to the complex couch potato patterns. But perform some holdings within these finance do as well as earnestly treated fund? Element of my role were to examine Tangerine clients’ shared fund stored from the most other financial institutions and you will common financing people in order to the new Tangerine list-founded shared financing profiles (they failed to yet , supply the ETF portfolios at the time). It absolutely was very rare to find a high-commission common fund blend you to beat the newest Orange approach over the long-identity.

- When the, but not, you’ve got money which you consider your’ll you want use of within this two years or smaller, it might be wise to adhere risk-100 percent free possibilities, including high desire savings accounts and you may GICs.

- This approach is fantastic for people which like a hands-from method to spending and want to steer clear of the fees and you will difficulty of definitely treated money.

- The definition of is increasingly popular lately as the all of our community grows more sedentary.

- As a result of the higher volatility, payouts require some determination, but once they happens they can be huge.

- To learn more about performing probably the most taxation-productive ETF Couch potato profile, look at this post.

The new Innovative All the-Collateral ETF Collection (VEQT) enables you to do so which have just one financing. That it ETF is approximately 40percent Us equities, 30percent Canadian equities and 30percent around the world equities, level each other create and you can growing locations. They holds nearly 14,one hundred thousand carries worldwide, and it becomes immediately rebalanced, it demands simply no maintenance—all to possess an annual management costs ratio (MER) percentage of just 0.24percent. Bonds usually go up in the value whenever inventory places capture a life threatening strike, so they do the stock market chance (2022 might have been an exception). When you’re indeed there’s no be sure of the inverse matchmaking, it’s fundamentally acknowledged one holding stocks and you can bonds along with her makes an excellent lower-chance collection. Before you can become an inactive individual, you need to dictate an educated investment allotment (portion of carries, securities, an such like.) to suit your collection considering their exposure tolerance and you will time horizon.

Tips Get Canadian Passive’s Doing it yourself ETF Portfolios

I’ve already been discovering about the Canadian Couch potato financing means and you will possess some issues. Its ETF spending strategy feels as though it may be a fit for my personal RRSPs. Whenever i look at their model collection to own ETFs, he’s got only step three ETFs in their collection (ZAG, VCN, and XAW) plus the proportion of each ETF transform considering your risk top. Investor 1 receives an excellent twenty five,000 windfall and you may requires the brand new coach to incorporate they in order to their collection.

M1 Finance The new Bonus Reinvestment Features Try Right here! (Slip Peek)

And you still have much more assets — 535,163 — than simply when you began. For those who already been 30 years ago, you’d the main benefit of the newest bull market of your own ‘1990s. While the property value your portfolio declined inside the around three of the initial a decade, the new hurry of your later ‘1990’s carried you thanks to about three successive several years of the brand new dotcom freeze because the the new millennium first started. A portfolio from only gas and oil companies is probably reduced varied than just a portfolio you to definitely invests across the multiple groups and you may regions. The amount of ETFs to incorporate in your own profile relies on the number of fundamental holdings that ETF has.

You will need to periodically opinion and you will rebalance the fresh collection to take care of the desired investment allowance. You have a portfolio out of 100percent equities, and you are in addition to repaying loans. The borrowed funds prepayments is actually an audio decision, nevertheless they’re also not only a different way of to find fixed-income. So just make sure you are comfortable with the risk of a great a hundredpercent equity profile. Justin reviewed the brand new Long lasting Collection playing with Canadian investigation to have T-costs (cash), silver and you will long-term ties. For the inventory allotment he made use of a level split up out of Canadian holds as well as the MSCI World List.